Gross Profit Versus Gross Revenue

- Monday, July 13, 2009, 11:43

- Property Insurance

- 3 comments

Should the Business Interruption risk be insured on a Gross Profit or Gross Revenue basis? We are often presented with this issue.

Should the Business Interruption risk be insured on a Gross Profit or Gross Revenue basis? We are often presented with this issue.

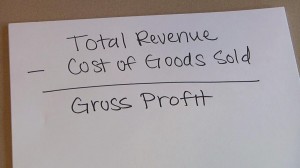

The answer requires an understanding of “Gross Profit” and “Gross Revenue”.

Gross Profit is just a level of earnings. This level varies between accountants and industries. For insurance purposes only one level of Gross Profit is relevant…. that which is defined in the insurance policy.

Paraphrased the Mark IV Industrial Special Risks Policy defines Gross Profit as Turnover plus Closing Stock less Opening Stock and Uninsured Working Expenses. Turnover is sales, Stock is the goods available for sale and Uninsured Working Expenses are those costs which vary directly with the level of sales. While this sounds technical it is clear that Gross Profit is less than Sales value.

In contrast, Gross Revenue is essentially Sales value. There may be some deduction for variable costs such as commissions but these are usually minor.

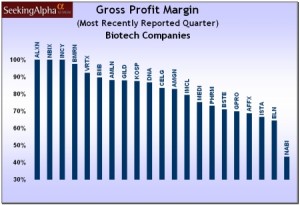

Gross Profit cover is suited to businesses which need the ability to deduct expenses which vary directly with the level of sales. It is inappropriate to insure these expenses as they will decline with the level of sales in the event of a loss. Examples are purchases, energy, freight, packaging, etc.

If variable costs such as these were not deducted premium dollars would be wasted. The insured would not receive compensation for these costs as they would be deducted from any settlement because they would not be incurred. They would reduce in proportion to any lost sales.

Gross Profit cover is suited to those businesses which have variable costs e.g. manufacturers, retailers, importers, wholesalers, etc.

Gross Revenue cover is suited to businesses where the expenses which generate the sales are largely fixed i.e. they do not vary directly with the level of sales.

Examples include consultants, insurance brokers, insurers, accountants, architects, solicitors, real-estate agents, etc.

Sometimes we are required to prepare a claim where the Basis of Settlement has been specified as Gross Revenue but it should have been declared as Gross Profit and visa versa. This can lead to unnecessary complications.

“The important thing is not to stop questioning”

Albert Einstein.

The cover should reflect the risk.

Copied from an article posted at insuropedia

About the Author

3 Comments on “Gross Profit Versus Gross Revenue”

Write a Comment

Gravatars are small images that can show your personality. You can get your gravatar for free today!

Pak, mau tanya tentang gross profit. Apakah gross profit dapat mengurangi nilai klaim?

Terus stiap property pasti ada pajak nya. Apakah pajak tersebut dapat mengurangi klaim juga?

Terimakasih atas perhatiannya

Dewi, Gross Profit ada jenis asuransinya tersendiri yaitu “Business Interruption”

Untuk asuransi property – ganti rugi tidak termasuk unsur “profit”

Pajak atau dalam hal ini VAT atau PPn – Jika Tertanggung adalah “Badan Usaha” maka VAT dapat “recoverable” atau di perhitungkan dengan pajak yang kita bayarkan (pajak terhutang) – sehingga VAT dikeluarkan dari komponen klaim. Namun untuk klien “Perorangan” – VAT dijamin karena tidak bisa di “recoverable” dari DitJen Pajak

d3pbwh

c6eojq