Marine Cargo Insurance

- Monday, June 30, 2008, 10:41

- Marine Cargo Insurance

- 15 comments

Untuk membaca versi bahasa Indonesianya, Silakan Klik disini

Moving cargo from one place to another whole over the world by air, sea or inland transit is very risky that’s why you need Marine Cargo Insurance

Type of Covers: Marine Cargo Clauses

1.Clause A (All Risks)

Covers everything except listed exclusions

2.Clause B or C

Covers only those incidents specifically listed

| Risks |

Clause B |

Clause C |

| Fire or explosion |

Yes |

Yes |

| Vessel or craft being stranded, grounded, sunk or capsized |

Yes |

Yes |

| Overturning or derailment of land conveyance |

Yes |

Yes |

| Collision or contact with any external object other than water |

Yes |

Yes |

| Discharge of cargo at port of distress |

Yes |

Yes |

| Earthquake, volcanic eruption or lightning |

Yes |

No |

| General average sacrifice |

Yes |

Yes |

| Jettison |

Yes |

Yes |

| Washing overboard |

Yes |

No |

| Entry of sea, lake, or river water |

Yes |

No |

| Total loss of any package lost overboard or dropped whilst loading or unloading from vessel |

Yes |

No |

Yes: Covered — No: Not Covered

Typical Policy Inclusions

Marine Cargo Clause A provides coverage for:

1.Coverage for the transit of goods from warehouse to warehouse

2.Coverage for loading and unloading risks

3.Coverage for General Average losses and General Average Contributions

4.Coverage for the risk of war, strikes, riots and civil commotions

5.Coverage for risks of theft, pilferage and non delivery

Principal Exclusions

Marine Cargo Insurance does not cover:

· Ordinary leakage, loss of weight / volume, wear and tear or inherent vice

· Delay, loss of market or consequential loss

· Insufficiency or unsuitability of packing or preparation

· Mechanical, electrical or electronic breakdown or malfunction where no external evidence exists of damage from an insured event

· Rusting, Oxidation, Discoloration, Contamination where no external evidence exists of damage from an insured event

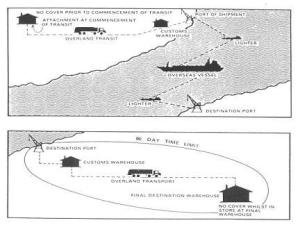

Warehouse to Warehouse

Duration of the Marine Insurance Policy covers transit of goods from warehouse to warehouse as outlined below:

Insured Value

Under Marine Cargo Policy, you may insure CIF+10%

•Cost

•Insurance

•Freight

•10% anticipated profit

Rating Factors

Rate for Marine Cargo Insurance is ranging from 0.1% to 0.2% It however considerable under following factors:

-

Kind of Goods / Cargo: general cargo, machinery, etc

-

Method of Packing: FCL or LCL

-

Type of Vessel: Steel Vessel, TB/BG etc

-

Voyage: domestic or overseas

-

Terms & Conditions: Clause A, B or C

How to Insure?

It provides Single Voyage or Monthly Declaration

It simply to provide info or documents i.e. copy of Bill of Lading, Invoice and Packing List

For inquiry or to obtain a Quote

Please call me at +628128079130

Or email: imusjab@qbe.co.id

by IMAM MUSJAB at http://ahliasuransi.wordpress.com/

About the Author

15 Comments on “Marine Cargo Insurance”

Trackbacks

Write a Comment

Gravatars are small images that can show your personality. You can get your gravatar for free today!

Dear Sir

IMAM MUSJAB: Yes correct, these perils are typically included – by endorsements

Marine Cargo Clause A does not cover war, strikes, riots and civil commotions risk. To cover this you have to take ICC war, strikes, riots and civil commotions Risk. But you have mentioned it is covered. Even New ICC A (1/1/09) also does not cover war, strikes, riots and civil commotions (condition # 6 and 7 )

Thanks

Tarik ur Rahman

Bangladesh

Thanks for the informative post guys, been following your blog for the past several months while trying to lose weight for my wedding on the Cambridge diet plan and it’s going really great. I’m down about 20 pounds in the past few months and your site has really inspired me to keep trying. Fantastic job.

Halo imam,…

Belum lama ada EU Sanction ruling (Council Regulation No. 961/2010), apakah hal ini juga berlaku untuk ekspor barang dari Indonesia (berkenaan dgn cover asuransi MC)?..makasih sebelumnya dan selamat tahun baru 2011…

Berlaku juga lah..siapa yang berani ama EU?? Happy New Year & Sukses Alfrest

Dear Pak Imam,

Mohon diberikan penjelasan lebih detil dengan “Agreed Value”. Bagaimana jika barang tersebut diasuransikan jauh lebih tinggi dengan nilai invoice barang itu sendiri? Bagaimana penyelesaian klaim jika terjadi total dan atau partial loss?

Terima kasih banyak atas penjelasannya terlebih dahulu.

“Agreed Value” adalah harga yang telah disepakati oleh Tertanggung dan Penanggung sebagai penggantian dalam hal terjadi Total Loss, dalam “Partial Loss” tentu penggantian adalah “cost of repair+freight+recovery+etc”. Bagaimana jika “Agreed Value” jauh lebih tinggi dari Invoice? Bisa saja namanya juga “Agreed Value” asal sudah disampaikan dan disepakati oleh Penanggung sedari awal oleh karenanya perlu iktikad baik untuk menyampaikan “breakdown” harga-harga tsb. kalau tidak disepakati dari awal bisa saja nantinya akan timbul kecurigaan akan adanya “iktikad tidak baik”. Agreed value yang wajar untuk asuransi marine cargo adalah CIF+10%, tapi as i said bisa saja +20%, +30% atau bahkan +100% bahkan lebih untuk produk-produk tertentu

Pak Imam,

Terima kasih banyak atas penjelasannya.

Pak, dimana saya bisa dapatkan buku-buku Marine Insurance (Hull&Cargo)? Saya sudah cari di berbagai toko buku tp tidak ada. Ada referensi pak?

kalo di Indonesia jarang sekali, biasanya kita baca yang terbitan “Witherby” seperti “Analysis of Marine Insurance Clauses – ITCH” RH Brown dll silakan cari online. kalo yang di Indonesia mungkin ada yang JT Sianipar (Hull) atau Pak FX Sugiyono (P&I) bisa di cek di Gramedia

Yth P’Imam,

Saya sangat tertarik dengan artikel-artike bpk.

Mohon penjelasannya pak, apakah di asuransi marine cargo terdapat “adequacy of sum insured” dan apakah dapat diberlakukan average condition terutama pada cargo “mesin” (life span)?

Terima kasih pak.

Marine Cargo tidak berlaku “Average” Pak. khusus untuk mesin second hand biasanya diberlakukan “Institute Replacement Clause” yang prinsipnya mirip “Average” (sekali lagi mirip tetapi bukan average condition)

Sedikit menambahkan, pada dasarnya marine insurance, under insurance juga berlaku dalam perhitungan klaim ganti rugi, utamanya untuk cargo (lihat MIA 1906 Section 81) dan ketentuan ini still a good law.

Jadi pengecekan harga pertanggungan “seperti” yang dilakukan di non-marine untuk mengetahui adequacy of sum insured juga dilakukan, meski sedikit berbeda penerapannya.

Secara spesifik, polis marine cargo memang tidak dilekatkan dengan average clause seperti di polis2 property, karena MIA 1906 sudah mengatur ketentuan under insurance.

Salam,

NR

Pak Imam,

Apakah didalam marine cargo penggelapan yang dilakukan oleh supir dijamin?, misalnya ada pengiriman barang melalui darat dengan menggunakan transporter, lalu truk yang mengangkut barang tersebut dibawa kabur oleh supinya.

Thanks

Dijamin, Pak sepanjang tertanggung bukanlah pihak transporter itu sendiri.

Kalau tertanggungnya transporter bagaimana pak?

apa jenis-jenis hijacking dan robery itu pak

Hijacking (pembajakan) dan Robbery (perampokan) – dalam konteks asuransi pengangkutan barang adalah sama saja Pak yaitu berupa pengambil-alihan kargo oleh orang lain dari luar kendaraan (alat angkut) dengan unsur kekerasan atau paksaan yang kadang juga diikuti dengan pengambil-alihan kendaraan (alat angkut) nya.

ICC A menjamin hijacking dan robbery. sedangkan ICC B dan C tidak menjamin